Deal Showcase

Financing middle market real estate across all assets types, our deal showcase illustrates the wide array of assignments completed on behalf of our clients.

- All

- Deal Spotlight

- Hotels

- Industrial

- Multifamily

- Office

- Retail

Retail Chain NNN Cash Out Refi Greater Los Angeles Area, CA

Greater Los Angeles Area, CA

- $17,100,000 cash out refi on 4 retail stores for WSS footwear.

- 70% LTV

- 15 year term with 30 year amortization

- No prepayment penalty

- Funding Source: Credit Union

Restaurant Refinance Downtown San Diego, CA

- $4,250,000

- Funding Source: Money Center Bank

- Restaurant and bar tenants

- Brick building with historical facade

- Major tenant roll within 5 years

- 10 year low term

- Sub 5% fixed rate with early 90 day rate lock to protect against rising interest rates

Industrial Cash-Out Refinance in Vernon, CA

Distribution Warehouse & Cement Plant

City of Vernon, CA

- $18,000,000

- $4.5 cash out to sponsor after purchasing in 2011

- 5 year term / 30 year amortization

- Aggressive underwriting & appraisal with only a 1.17x discs & 4.5% cap rate

- Warehouse tenant not in occupancy

- 12+ acres inclusive of 100,000 sf. distribution warehouse, cement plant, and pallet warehouse

- Superior location at 27th & Alameda

- Funding Source: Private east coast relationship lender

Non-Credit Single Tenant Financing in Culver City, CA

Multifamily Refinancing Anaheim, CA

- $3,850,000

- 1.15 disc on actual rate

- 7 year term / 30 year amortization

- Funding Source: Regional Bank

- 19 Unit Class B Multifamily awarded assignment over direct lender quotes with cost savings analysis over 7 year hold

- Handled all uw and loan processing while client was out of the country

Partnership recapitalization bridge loan in Mar Vista, CA

Retail Condo Interest Only Refinance in Downtown San Diego, CA

Gaslamp Quarter of San Diego, CA

- $5,000,000

- 43,000 sf retail condo under large residential towers

- Gaming (Off track betting) tenant created issues for many lenders

- Open prepay structure for maximum sponsor flexibility with possible sale or cash-out refi in the near to mid term

- 4.5% Fixed Interest Rate

- 5 year term / Interest Only

- Funding by local bank

Office acquisition & rehab bridge loan in West Covina, CA

19 Unit Apartment Building in North Hollywood, CA

Leasehold financing on unopened hotel in San Diego, CA

Distribution and Manufacturing Center in Morristown, TN

Recently stabilized multifamily refinance in Canoga Park, CA

Non-credit restaurant retail in Los Angeles, CA

Multifamily Construction Van Nuys, Los Angeles

- $4,980,000

- 73% LTV

- Funding Source: Local Bank

- 19 unit multifamily construction

- General Contractor changed after LOI execution, however we were able to keep the economic terms the same & increased proceeds by $400k in a positive rate environment

Condo Construction Loan in West Hollywood, CA

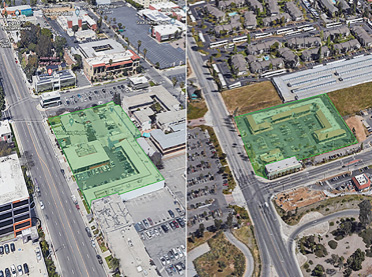

Acquisition and Entitlement Bridge Loan in Culver City, CA

Los Angeles transit oriented mixed use project across from new opened Expo Line stop

- $10,200,000

- 24 month term with fixed rate

- Time sensitive closing and complex JV ownership

- 64% LTC inclusive of soft development/entitlement costs with no interest reserve or impounds

- 1 acre with existing structure

- Funded by CA based private bridge lender

Grocery anchored center cash-out in Bakersfield, CA

Tertiary Strip Center Cash Out Refi Douglasville, Georgia

Value‐add Multifamily Acquisition Memphis, Tennessee

Hotel acquisition & rehab loan in Phoenix, AZ

Multi state apartment portfolio refinance

Acquisition financing for 5 story brick multifamily in Los Angeles, CA

1928 multifamily in Beverly Hills, CA

680 unit multifamily refinance in Newark, NJ

Hotel portfolio recapitalization in Utah & N. Carolina

Retail portfolio cross collateral credit enhancement in Los Angeles

Credit tenant office acquisition in Houston, TX

Note purchase acquisition financing in Tallahassee, FL

Office acquisition bridge loan in Tucson, AZ

Discounted payoff office acquisition financing in Albuquerque, NM

Historic hotel acquisition & rehab in Salt Lake City, UT

Lake Tahoe 2 Hotel Acquisition & Rehab

Retail & non credit warehouse cross collateral acquisition

Suburban Office Cashout in Agoura, CA

Retail & Office Foreclosure

Shopping Center Foreclosure

Apartment Building in East LA

2 Property Retail Portfolio in Greater Los Angeles

Multifamily Cash Out Altadena, CA

22 Unit Building South Los Angeles, CA

Quick Close Acquisition Loan

Mobile Home/RV Park Cash-out

Mixed-Use Refinancing Downtown San Diego, CA

Class C Multifamily Cash Out Koreatown, Los Angeles, CA

Class C Motel Acquisition West Adams, Los Angeles, CA

4plex Acquisition Financing Los Angeles, CA